NRIs are not issue to tax in India. But whenever they get paid cash flow in India, they must pay out tax on it.

hi there Anamika, We’re sorry for that inconvenience you needed to deal with. we wish to research this subject and solve this challenge on priority in your case.

you will need to file your return ahead of the owing day, if you have sustained a decline while in the monetary 12 months and if you'd like to carry ahead it to the subsequent year for adjustment versus the following yr’s profits.

fall your e-mail ID and cellphone no. here and We are going to notify you when the ITR filing solutions start off on ClearTax.

Filing profits tax returns and buying tax-saving mutual money, SIP, and ELSS just received simpler! Download the BLACK App by Cleartax and finish your profits tax e-filing in only three minutes! Allow Cleartax get taxes off your head.

Gupta experienced also taken a major guess on the GST small business, ramping up a 30-member staff in mid-2016 to above three hundred folks in 8 months. almost all of the funds elevated by the business was invested in GST. “If the most effective experienced not worked out, we would've died,” he suggests. The gambit paid out off. the business now earns over 85 % of its earnings from enterprises.

Laura Thomas is definitely the operator of Legacy authorized Planning, LLC. She advises persons, families and modest enterprise of their estate arranging requirements and tax needs. Laura can take excess treatment to accommodate her purchasers’ needs, comprehension that estate administration is usually emotionally complicated, Which a well shaped system is often important to serving to a relatives get through a difficult time.

you may e-mail the location proprietor to let them know you have been blocked. be sure to website include Anything you were undertaking when this website page came up plus the Cloudflare Ray ID identified at The underside of the webpage.

This is because the ITR return serves as being a proof of income statement for several needs like bank loan acceptance, VISA programs, credit card purposes, assert money tax refunds and set off and carry forward of losses, etc.

ClearServices - a specialist session company that can help the customers determine their complications and achieve their methods.

comprehensive source chain Resolution for final Handle, effortless collaboration, and certain compliance

I very propose ClearTax to all consultants/business people like me who want steering to know how the cryptic Indian tax law applies to them.

You may also download the ITR-V acknowledgement throughout the ‘obtain Receipts’ alternative, and also your ‘ITR sorts’ from there. you could click the ‘look at facts’ link to begin to see the standing of your ITR, which includes e-verification position and refund challenge status if any.

for Indian tax payers. we're Clear. related funds for Indian tax payers. Our mission will be to simplify finances, get monetary savings and time for an incredible number of Indian organizations and people. we have been a technological innovation business that builds trustworthy, valuable and insightful platforms for our consumers to run their finances and improve their romantic relationship with dollars.

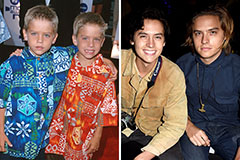

Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!